UK tax system explained: tax brackets, PAYE & the 60% tax trap

November 18, 2025

If you are a full time employee, your employer pays your taxes through PAYE. PAYE stands for pay as you earn. In simple words, it is a system employers use to deduct tax and NI from wages. I’m planning to cover most common concepts, they are intertwined:

- Tax brackets

- Tax code

- Personal allowance

- Savings personal allowance

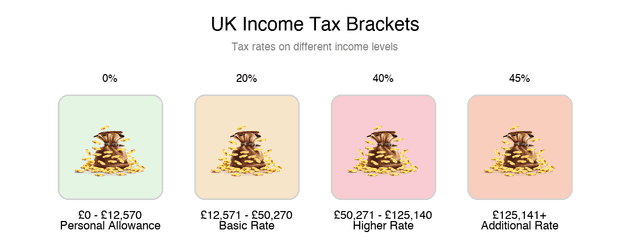

UK Income Tax Brackets Explained (2025/26 Rates)

Consider tax brackets as buckets of money you have to pay a tax on. These brackets and personal allowance in the UK are set by Chancellor of the Exchequer. Last time they have been set by Rishi Sunak in 2021 who froze thresholds; Jeremy Hunt extended the freeze and is due to remain there until April 2028. Income tax on earned sum in a tax year is charged at three rates: the basic rate, the higher rate and the additional rate.

- Up to £12570 - 0% no rate applied, this is tax free

- From £12571 - to £50270 - taxed at basic 20% rate and applies only to its slice

- From £50271 to £125140 - taxed at higher rate, 40% applies only to its slice

- Whatever is earned above £125140 is taxed at 45%, called additional rate

UK Income Tax Brackets - Visual representation of tax rates on different income levels

The 60% Tax Trap: What Happens When You Earn Over £100,000

There’s a catch known as the "60% tax trap". When your income exceeds £100,000, your Personal Allowance (£12,570) begins to taper off. For every £2 you earn above £100,000, you lose £1 of your tax-free allowance.

This creates a very high effective tax rate. Let’s look at an example. Anna is a Senior Software Engineer earning £100,000. Her company offers £250 for a weekend on-call shift.

- Income Tax: She pays 40% on the £250 (£100).

- Lost Allowance: The £250 extra income reduces her tax-free allowance by £125. This £125 is now taxed at 40%, costing her another £50.

- National Insurance: She also pays 2% NI on the £250 (£5).

Total Deductions: £100 (Income Tax) + £50 (Lost Allowance Tax) + £5 (NI) = £155. Take-home Pay: £250 - £155 = £95.

Anna effectively keeps only 38% of her extra earnings. This is often called the "60% tax trap" because the effective Income Tax rate is 60% (40% standard rate + 20% from the lost allowance). When you add the 2% National Insurance, the total marginal deduction rate hits 62%.

For £95, she has to stay home, monitor dashboards, and potentially wake up at midnight, missing out on plans with friends and family. She still earns the extra money. But is it worth it?

Take-Home Pay Calculator: Is Extra Income Above £100k Worth It?

Tax Calculator for Extra Income (£100,000+)

UK Savings Personal Allowance: Tax on Interest Explained

You have a savings personal allowance. For example, if you have a saving account and earn interest, they are taxable as well, however you don’t have to pay tax on the first £1000 if you’re a basic rate tax payer (meaning, you earn less than 50270 a year), or first £500 for those who are higher rate tax payer. You don’t have any savings allowance if you earn more than £125140 a year. If you do, it’s less tax-efficient because all interest becomes taxable. Surely you’d still earn some interest, but unlikely to beat inflation. Find different options to protect your money from inflation and taxation (tax wrappers, investing within a general investment account and getting capital gains, or using Premium bonds to park cash accessibly). You can read more about it in my article about investments.

How UK Income Tax Is Calculated: Step-by-Step Examples

Let’s say you earn £30000 a year (your total gross income), your tax code is default 1257L which means you don’t pay tax on first £12570 pounds. You have to pay a 20% tax only on the slice of 30000-12570=17430 - this is what HMRC would call a taxable income. 20% on this sum is £3485.8.

Example for earning £80000

If you earn £80000 a year (your total gross income), your tax calculations are the following:

- the first £12570 --------------------------------------- no tax

- (£50270-£12570) = £37700 ------------------------------- 20%

- whatever is above £50270: £80000-£50270 = £29730 --------- 40%

In total, your tax liability on £80000 earnings are:

0 + (37700 * 0.2) + (29730 * 0.4)

0 + 7539.8 + 11892 = 19432

This is how much income tax you pay in a year. This is not your net income yet, as you still have to pay NI - national insurance.

National Insurance Contributions (NIC): What You Pay and Why

National Insurance is paid separately from income tax. It is calculated on your gross salary, and it does not reduce your taxable income for income tax purposes.

What Does a Tax Code Change Mean for Your Payslip?

Changes to your tax code meaning changes to your tax free personal allowance. Let’s say, you had earned some additional income apart from your main employment in the previous year (might be % on savings you earned). HMRC needs to collect tax on that. Let’s say they calculated you owe them 234 pounds. One way they can collect a tax is by reducing your tax free allowance and changing your tax code. What often happens is that you receive a letter that says that your tax code is changing from 1257L to 1140T. It means that in your case, now 20% tax applies starting at 11400 pounds, so you’ll have to pay an 20% of that. Calculations: (12570-11400)*0.2 = 234 extra in tax.

Understanding how tax works in the UK takes a bit of getting used to, especially when terms like “personal allowance”, “tax code”, or “savings allowance” all overlap. Once you know how the pieces fit together, it becomes much easier to read your payslip and plan your finances with confidence. Whether you’re earning £30k or approaching higher tax bands, the key is simply knowing what applies to you and why. And remember: your tax code can change, savings interest can be taxed, and the personal allowance begins to taper for higher earners. The more familiar you are with it, the easier it becomes to make informed choices about your expenses and savings and avoid surprises.