Buying property in the UK can feel surprisingly opaque, especially if you come from a country where the rules are fundamentally different. Some of the key concepts around ownership simply do not exist in other countries, so in this post, I want to explain the basics and highlight the things I personally wish I had understood earlier.

Freehold, Leasehold & 6 More UK Property Concepts Explained

Property ownership is slightly different in Scotland.

In England and Wales, there are two main forms of property ownership: freehold and leasehold.

1. Freehold

With freehold, you own a property outright - the building, every brick, the land it stands on, everything above it and below (yes, some people in London dig down to create celars or bunkers). Most houses (terraced, semi-detached, detached) are freehold. Owning a freehold gives you a lot of control but not absolute freedom for changes. You need to obtain planning permission from local council for major alterations (extensions, structural changes) and must comply with building regulations. If the property is listed or in a conservation area, restrictions are even tighter. We'll cover the listed buildings in this post in p.6.

2. Leasehold

Leasehold means you own the right to live in a property for a fixed number of years, but not the land it stands on. The land and building are owned by a freeholder (also called the landlord). Most flats in London are leasehold. When you buy a leasehold flat, you are buying the remaining years on the lease. For example, if the original lease was 125 years and 35 years have already passed, you are buying a lease with 90 years remaining. In many cases, you can extend the lease later, either by agreement with the freeholder or through a statutory process — but this can be expensive.

Share of freehold

A share of freehold usually means that:

- The building is split into flats

- The flat owners jointly own the freehold (often through a company)

- Each flat still has its own lease

In practice, this often gives leaseholders more control over service charges, maintenance decisions, and lease extensions. It is generally seen as more attractive than a standard leasehold, but it still comes with shared responsibility and potential disputes between owners.

3. Lease length and “marriage value”

Lease length matters more than many first-time buyers realise.

Once a lease drops below 80 years, extending it becomes significantly more expensive - and we are talking about £10k+. This is because of something called marriage value.

Marriage value reflects the idea that extending a lease increases the property’s value. When the lease is below 80 years, the law requires this increase in value to be split 50/50 between the leaseholder and the freeholder. Above 80 years, marriage value does not apply. For example, a flat with a 80-year lease cost £400k. Same flat after extension to 170 years would cost £450k. Of this £50k increase you have to pay half to a freeholder. So your property in fact would cost you 425k + legal and valuation fees to all this kerfuffle. Properties with less than 80 years often come with a noticeable price cliff - this is why if you see an advertisement with an attractive price below market - lease length is one of the first things to check.

New-build flats typically come with very long leases (250 or even 999 years). By the time you buy, a year or two may already have elapsed since construction started, but practically speaking, this is not an issue.

Freehold generally offers more autonomy and is often more expensive. Leasehold is usually cheaper upfront and shifts much of the maintenance responsibility to a managing agent. From the first sight, freehold sounds better. But not universally “better” — it depends on your priorities.

4. Service charge

Leasehold properties come with a service charge. This covers the maintenance and management of shared areas and the structure of the building. Typical items include cleaning of communal areas, lift maintenance (if any), repairs of the building infrustructure - roof, pipes, you name it; fire safety system, building insurance, managing agent fees. Facilities like gyms, swimming pools, concierge services, or shared lounges can significantly increase service charges.

Older Victorian buildings are also notorious for high charges, as ageing structures often require frequent and costly repairs.

Freeholders do not pay service charges, but they must cover all maintenance themselves — from a leaking roof to a broken boiler.

5. Ground rent (“Peppercorn rent”)

Ground rent is a fee paid by leaseholders to the freeholder simply for the land.

Historically, ground rent could be substantial and sometimes increased aggressively over time. However, for new residential leases granted from June 2022, ground rent has effectively been abolished and reduced to a peppercorn (legally meaning zero financial value).

For older leases, ground rent may still apply, so it is important to check this carefully. Common figures would be £100–£300 per year.

6. Listed buildings

Some properties are listed, meaning they are considered to have historical or architectural significance. If a buidling is listed, its appearance must be preserved - you are restricted from changing windows, doors and façades. These rules apply regardless it is a freehold or leasehold.

7. Energy efficiency (EPC rating)

Every property in the UK has an Energy Performance Certificate (EPC) rating from A (most efficient) to G (least efficient). In practice, this tells you how well the property retains heat and how expensive it may be to run. Personally, I would only consider A–B ratings comfortable - spending my evening in 3 layers of wool socks over wintertime is not my cup of tea. Lower-rated properties often mean higher heating bills and a higher risk of damp and mould. And by the way, new builds are not a guarantee of good energy efficiency, nor are they a panacea against damp. I rented a flat in a 10-year-old building in central London and still ended up with mould in the corner. Even relatively recent developments can suffer from poor insulation or ventilation, so always check the EPC and inspect the property carefully.

8. Stamp Duty Land Tax (SDLT)

Stamp duty is a one-off tax paid when you buy property in England. The amount depends on:

- The purchase price

- Whether it is your first home

- Whether you already own property - owning property abroad (including different continents!) counts.

Rates are progressive, meaning different portions of the price are taxed at different rates. First-time buyers benefit from significant relief, while second homes attract a surcharge.

How Much Can You Afford? UK Mortgages & Interest Rates

Mortgages and interest rates

Most people in the UK buy property with a mortgage. The pound is considered a relatively stable currency, and inflation has historically been moderate, which is why, for many years, mortgage interest rates were fairly low by global standards.

Mortgage rates are closely linked to the Bank of England (BoE) base rate. When the BoE changes this rate (usually at scheduled meetings roughly every six weeks), banks adjust their own savings and lending rates accordingly.

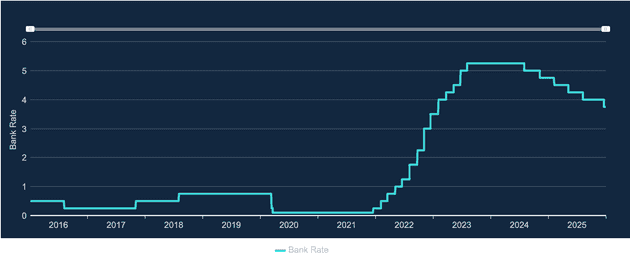

Over the last decade, the base rate looked like this:

Bank of England base rate Jan 2016-Dec 2025 taken from Bank of England Database

During Covid, rates dropped to unprecedented lows as the government and the BoE tried to stimulate the economy. After that, rates rose sharply. This was not a coincidence.

The increase was driven mainly by:

- A surge in inflation after Covid (supply chain disruptions, pent-up demand, higher energy prices).

- The war in Ukraine, which pushed energy and food prices even higher across Europe.

- Central banks raising rates deliberately to slow spending and bring inflation under control.

Even at a base rate of around 5.25%, buying can still make sense — and in my opinion, in London especially, where rent levels are high and long-term demand for housing remains strong. Whether it is right for you, however, depends on your personal circumstances, risk tolerance, and time horizon.

Mortgages: what can I afford?

If you are buying with a mortgage, lenders will usually look at three main things:

- Proof of income (payslips or accounts if self-employed)

- A solid credit history

- A deposit (minimum ~5%, but higher deposits usually mean better rates)

As a rough rule of thumb, you can borrow around 3.5–4.5× your annual income, but this varies depending on your circumstances, existing financial commitments, and credit profile. Banks are generally happy to lend you the maximum they consider affordable — but whether you should take the maximum is a separate question. You can start by using online mortgage calculators on bank or broker websites. These are informal tools that let you play with numbers and scenarios. At later stages, once your income has been checked, you’ll receive an official document called a Mortgage in Principle, which confirms how much a lender is willing to offer you.

Does this mean people pay mortgages until they are 70?

My mom was in shock when she heard that my mortgage is 30 years old. In a way, it stripped her of all the joy she had when I told her I'm buying my own home. Back in Ukraine, it's not common to have a mortgage for that long. However, in the UK, it's typical for first-time buyers to take mortgages for 30–35 years, but that does not mean they repay them for the entire term.

In reality, many people remortgage every 2–5 years. Circumstances change: incomes increase, households become dual-income, priorities shift. People often shorten their mortgage term over time or make overpayments. I know some people who paid off their mortgages in 15 years and some who are still paying off, approaching their 60s, but not because they have to, but because they have chosen so. Also, you can extend the term to reduce monthly payments and improve cash flow.

Leasehold vs Freehold: Which Is Right for You?

- Earnings and LISA constraints - Apart from having a limitation on how much one could borrow, people with Lifetime ISA has a property price cap (£450k) - it effectively rules out all freehold options in London. You can find more about LISA in my article here.

- Maintenance responsibility - As a single woman, I wouldn't want to deal with roofing issues, plumbing emergencies, or electrical problems on my own. Having these handled via a managing agent felt like a fair trade-off.

- Security - Ground-floor living has never felt secure to me. I am a city girl that grew up in Kyiv and always has been living in a flat. I just feel more comfortable being higher up, with distance from the street and a bit of a view.

- Gardens and outdoor upkeep - I have neither the skills nor the desire to maintain a garden. Outsourcing is costly, and neglecting it quickly shows.

What is the right for you depends on your lifestyle, risk tolerance, and long-term plans. Do the maths, run different scenarios, and choose what feels sustainable for you, not just what the bank is willing to lend.